Choosing the right insurance coverage is essential for any chiropractic practice, but it’s especially important for spinal decompression chiropractors. Partnering with a chiropractor business insurance provider ensures that practitioners have the necessary protection against liability claims, equipment damage, and unforeseen risks.

Without proper coverage, a single lawsuit or accident could put a clinic’s financial stability at risk. By working closely with an insurance provider that understands the unique challenges of spinal decompression therapy, chiropractors can focus on patient care with peace of mind. This partnership also helps streamline claims processes, making it easier to handle any legal or financial issues that arise.

What Is A Spinal Decompression Chiropractor?

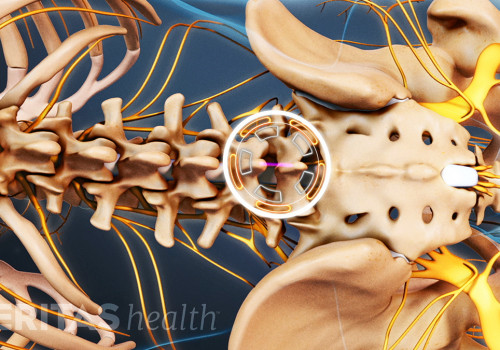

A spinal decompression chiropractor specializes in alleviating pressure on the spine through non-invasive, drug-free treatments. Spinal decompression therapy is a technique that helps relieve back pain, sciatica, herniated discs, and other spinal conditions by gently stretching the spine. This process creates negative pressure within the discs, allowing herniated or bulging discs to retract, reducing pressure on nerves and promoting healing.

These chiropractors use specialized equipment, such as motorized traction tables, to perform spinal decompression therapy. Unlike traditional chiropractic adjustments, which involve manual spinal manipulation, spinal decompression therapy focuses on controlled, gradual stretching to create space between the vertebrae. Patients who suffer from chronic back pain or nerve compression often seek spinal decompression therapy as an alternative to surgery or medication.

Spinal decompression chiropractors assess a patient’s condition through physical examinations, imaging tests, and medical history reviews. They then develop personalized treatment plans that may include spinal decompression therapy, chiropractic adjustments, lifestyle modifications, and rehabilitative exercises. The goal is to improve spinal alignment, enhance mobility, and reduce pain, allowing patients to regain their quality of life.

What Is A Chiropractor Business Insurance Provider?

A chiropractor business insurance provider offers specialized insurance coverage designed to protect chiropractic practices from financial risks. These providers offer policies that cover malpractice claims, general liability, property damage, and even business interruption. Since chiropractors work closely with patients, having the right insurance is essential to safeguard against potential lawsuits or accidents. Many insurance providers also offer coverage for employees, equipment, and cyber liability in case of data breaches.

Choosing the right provider involves comparing coverage options, costs, and customer support. Some providers cater specifically to healthcare professionals, ensuring tailored policies that meet industry regulations. Without proper insurance, a chiropractic practice could face significant financial losses in the event of a claim. Investing in a reliable insurance provider is a crucial step in running a successful and secure chiropractic business.

Key Reasons Why Spinal Decompression Chiropractors Should Work With Chiropractor Business Insurance Providers

As a spinal decompression chiropractor, it’s essential to recognize the importance of having a solid insurance policy in place. Partnering with chiropractor business insurance providers can safeguard both the practice and patients. Here are some key reasons why this collaboration is crucial:

Protection Against Malpractice Claims

Malpractice complaints can arise unexpectedly, even in the most well-intentioned practices. Having the right coverage ensures that the chiropractor and their practice are protected from legal costs and potential settlements, which can be financially crippling. Malpractice insurance specifically addresses errors that may occur during spinal decompression treatments, providing peace of mind.

Comprehensive Coverage for Patient Care

While spinal decompression therapy can provide significant relief, the risk of patient injury, however small, remains a concern. Chiropractor business insurance providers offer comprehensive liability coverage that includes bodily injury claims. This type of coverage is crucial in ensuring that both patient and chiropractor are protected if an injury should occur.

Legal Protection and Defense

Legal battles, especially in healthcare, can become lengthy and expensive. Chiropractor business insurance providers offer professional liability coverage, which covers the cost of defending against malpractice lawsuits, even if the chiropractor is found not at fault. This defense can be invaluable in protecting the practice from costly litigation.

Compliance with State and Federal Regulations

Many states require chiropractors to maintain specific levels of insurance coverage. By working with insurance providers, spinal decompression chiropractors can ensure they meet all legal requirements. This coverage can also help avoid penalties and license suspensions that could arise from non-compliance.

Tips When Hiring A Chiropractor Business Insurance Provider

Choosing the right chiropractor business insurance provider is crucial for ensuring comprehensive coverage. Here are some essential tips to consider when selecting an insurance provider:

Assess Your Coverage Needs

Before selecting an insurance provider, determine the types of coverage you need based on your practice size, services offered, and potential risks. Consider malpractice insurance, general liability insurance, property insurance, and cyber liability insurance, among others.

Check the Provider’s Experience in Chiropractic Insurance

Look for an insurance provider with expertise in the chiropractic industry. Providers with experience in insuring chiropractors will have a better understanding of the specific risks and coverage requirements for spinal decompression therapy and other chiropractic services.

Compare Multiple Quotes

Don’t settle for the first provider you find. Request quotes from multiple insurance providers to compare coverage options, pricing, and policy terms. Choose a provider that offers the best value while meeting your coverage needs.

Verify the Provider’s Reputation and Reviews

Research the provider’s reputation by checking online reviews, testimonials, and ratings from other chiropractors. A reputable provider should have positive customer feedback and a history of reliable service.

Understand Policy Exclusions and Limitations

Review the insurance policy carefully to understand what is covered and what is not. Pay attention to policy exclusions, limitations, and conditions to avoid surprises when filing a claim.

Check the Provider’s Claims Process

A smooth and efficient claims process is crucial when dealing with unexpected incidents. Choose a provider known for quick and hassle-free claims handling to minimize disruptions to your practice.

Ensure Customizable Coverage Options

Every chiropractic practice is different. Look for a provider that offers customizable coverage options to tailor policies based on your specific practice needs and risk factors.

Seek Recommendations from Other Chiropractors

Ask fellow chiropractors for recommendations on insurance providers they trust. Their experiences can provide valuable insights and help you make an informed decision.

Look for Providers Offering Risk Management Resources

Some insurance providers offer risk management resources, such as legal guidance, compliance support, and safety training. These resources can help chiropractors minimize risks and avoid potential claims.

Review Policy Renewal and Flexibility

Choose an insurance provider that offers flexible policy renewal options and the ability to adjust coverage as your practice grows. This ensures long-term protection without unnecessary coverage gaps.

Contact A Chiropractor Business Insurance Provider

Partnering with a chiropractor business insurance provider is essential for spinal decompression chiropractors to protect their practice and ensure long-term success. Having the right insurance coverage safeguards against potential liabilities, patient claims, and unexpected financial risks. It also enhances credibility and trust, reassuring patients that their care is backed by a well-protected business. So, if you want to learn more about chiropractor business insurance providers, contact ChiroSecure.

ChiroSecure has been a trusted provider of chiropractic business insurance services for more than 30 years, offering affordable rates to chiropractic practitioners and massage therapists. They understand the ever-growing demand for comprehensive malpractice insurance and the need for a proactive approach to risk management.

With access to a trusted insurance company like ChiroSecure, your business can grow to its optimum potential in new ways because you can operate with peace of mind, knowing you have the necessary protection from malpractice complaints. Contact them today.